How Property Management Software Works for Property Portfolio Managers

Is there a limit to the number of buy-to-let properties one can own in the UK?

The simple answer is no! One can own as many buy-to-let properties in the UK as they like and can afford.

The real estate sector prevails with a particular group of investors who can acquire the best assets that can last the test of time and accrue more value.

The portfolio of a property investor is a significant source of passive value. High-value assets are present, but there are also a lot of hazards to balance out any possible profits. It brings up the purposeful requirement for portfolio management resources. Property management software can be a great idea for property portfolio managers, as it can help them streamline, automate and centralise a wide range of tasks involved in managing a portfolio of properties for clients.

Key Considerations for a Property Portfolio

Property investing holds a creative stance where technological advancements and process innovations end up changing or entirely upending market patterns. Consider Airbnb as a great example, which has given lodges, hotels, and B&Bs fierce competition by elevating short-term homestays and residential rentals to the forefront of the hospitality industry.

Using a static strategy to manage all of your investments can be challenging. To create a resilient property portfolio, investors must focus more on creating a wide range of investments, including different types of property, a variety of locations, and business ideas.

With all these considerations, it puts the onus on the property manager to create the best asset allocation and property diversification strategy. The good news is that with the help of the right kind of property management software, managers can simplify all the following tasks:

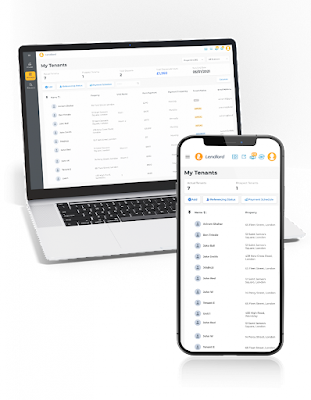

Enjoy a single centralized platform instead of managing separate spreadsheets, databases and documents

Monitor loan-to-value (LTV) ratio for property portfolio for each client and track equity all from a single dashboard

Have the landlord software gain instant access to tenant data, rental payments, lease agreement statuses, property maintenance statuses and requests and other important information

Enjoy a cohesive process for adding a new property to the portfolio and relevant information for growth and diversification

Have a backup of digital copies of important deeds and documents in one place.

Therefore, a centralised approach to property management software can be a valuable tool for property portfolio managers who are looking to improve efficiency, reduce costs, and deliver a consistent quality of support to clients. Moreover, teams can work from a single location with the need to conduct multiple site visits and in-person reviews.

Scheduling Made Simpler on a Property Portfolio Management Software

Portfolio managers may more easily keep track of crucial dates and deadlines, such as lease renewals and rent payments, and can provide reports on occupancy rates, revenue, and expenses by using property management software. These advantages can assist portfolio managers in making better decisions about the real estate owned by their clients and improving the performance of the portfolio as a whole.

Technological Innovations Aid In Enhancing The Quality And Clarity Of Client And Property Portfolio Manager Communications.

There is minimal space for confusion, misinterpretation, or "you were supposed to contact me" moments when managers and clients communicate via a pre-established interface for obtaining, processing and managing information and management requests. Faster resolution of maintenance issues and other tenant concerns has been made possible by the most cutting-edge landlord software, like Lendlord, which has significantly reduced workload and communication risks for property managers.

Comments

Post a Comment